Have You Heard About the "US Stocks" on the Blockchain?

Recently, more and more crypto trading platforms have begun exploring the innovative direction of "asset tokenization". Besides the stablecoins and gold tokens we are familiar with, a special type of on-chain asset has quietly emerged - "US stock tokens" or "synthetic US stock tokens". Products like MCDX and TSLAX are two representative products recently listed on the WEEX exchange, tracking the stock price trends of McDonald's and Tesla respectively.

So, what are they exactly? What investment goals can users achieve through these tokens? Are these products compliant? Let's discuss this today.

xStock Tokens: Not Actual Stocks, But Synthetic Assets

First, it must be clarified that MCDX and TSLAX are not actual US stocks and do not grant the purchaser any shareholder rights, voting rights, or dividend rights. They are "synthetic assets" issued by third-party protocols, essentially tracking traditional stock price movements through on-chain oracles, allowing users to trade and speculate based on market prices.

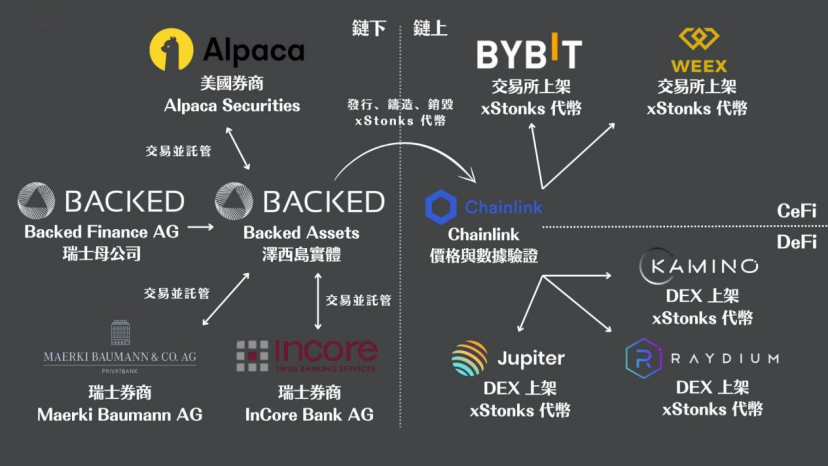

These products are generally classified as "synthetic assets" or "stock price simulation products", with a compliance framework different from traditional securities. On the WEEX exchange, these two products come from the external xStock system, part of on-chain asset innovation. Users can trade using USDT without needing to open a traditional brokerage account.

This form allows users to "simulate" US stock price changes to capture market opportunities, but does not constitute ownership or related rights to actual stocks.

Users should carefully read the platform's risk warnings before participating in trading and understand that such products may have higher price deviation or volatility risks due to oracle mechanisms, trading depth, and settlement rules.

Why Have "Blockchain US Stocks" Emerged?

The emergence of US stock tokens (synthetic assets) reflects the following industry trends:

• The digital asset market's demand for "bridging" traditional financial products is rising;

• More users want investment tools beyond the crypto market;

• Trading platforms are trying to introduce low-threshold, high-liquidity cross-asset trading entry points.

In the long term, these tokens may become part of the "asset tokenization" track, together with stablecoins, RWA (real-world assets on-chain), forming a more complete Web3 financial ecosystem.

WEEX's Strategic Significance

As an explorer of compliant synthetic asset ecology, WEEX exchange has chosen to list synthetic tokens like MCDX and TSLAX, simultaneously providing market chart support, offering users an efficient, low-threshold speculative tool. Unlike traditional brokers requiring overseas account opening and bank card binding, on WEEX, users only need a wallet or registered account to start trading.

This provides a way for users in strictly regulated regions or newcomers who haven't accessed traditional US stock markets to experience global top stock price fluctuations.

Of course, the platform also emphasizes risk control and compliance boundaries, and will gradually optimize synthetic asset disclosure and trading experience as national regulations evolve.

Who is Suitable for Such Trading?

In summary, synthetic US stock tokens are not suitable for long-term value investors because:

• They do not have shareholder rights, dividend rights, or voting rights in shareholders' meetings;

• They may have significant price deviations during volatile market conditions due to on-chain mechanism design;

• They cannot directly enjoy policy dividends or actual business growth benefits of the US stock market.

However, for users looking to capture short-term trends with some contract trading experience, these products offer another perspective to observe and participate in global markets.

Future Trends: More Tokenized Assets on the Horizon?

As US stock tokens, RWA, and stablecoins collectively build the "asset layer" of Web3, we can expect to see more:

• Real estate mortgage tokens

• Government bond/bond synthetic assets

• Dividend-type stablecoins for listed companies

Although the compliance path is still being explored, there's no doubt that asset tokenization has become a bridge for blockchain to enter mainstream finance.

Understanding Product Attributes Always Comes First Before Trading

Whether you're a crypto veteran or a Web3 newcomer, synthetic assets always belong to "innovative high-volatility" products. Understanding their design mechanisms, compliance boundaries, and trading logic is far more important than blindly following trends.

Platforms like WEEX exchange, by connecting to diverse synthetic asset protocols, allow traders to experience diverse asset trends, representing how the crypto ecosystem is continuously "moving towards the mainstream". In the future, we may see more on-chain assets breaking category boundaries, getting closer to reconstructing the real financial world.