On June 4, 2025, South Korea's newly elected President Lee Jae-myung was officially sworn in. The arrival of this new president is not just a political change, but could potentially become a crucial variable influencing the global digital asset market landscape.

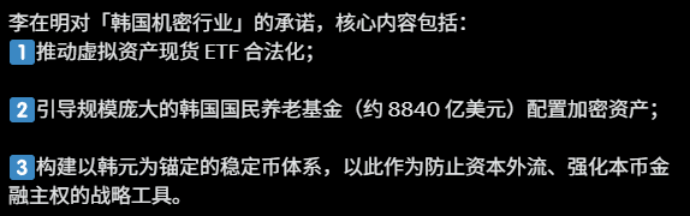

As the world's third-largest crypto trading market, South Korea has long been one of the "bellwether" countries in the digital asset ecosystem. During his election campaign, Lee Jae-myung clearly expressed support for crypto market development, including promoting a clearer regulatory framework, introducing digital asset custody systems, supporting central bank digital currency pilots, and even proposing the issuance of a stablecoin anchored to the Korean won.

Now that he is in office, will these policies be gradually implemented? And what chain reaction will this bring to the crypto markets in Asia and even globally? WEEX Blog will break down the market logic behind this political transition from several dimensions.

I. Why is South Korea so important? More than just a "trading powerhouse"

As a country with a population of just over 50 million, South Korea has long been among the top three global crypto markets for several reasons:

• High retail investor proportion: South Korea is a typical retail-dominated market, with about 30% of the population holding crypto assets;

• Unique market structure: Local exchanges like Upbit and Bithumb have extremely high domestic market share, with a complete Korean won direct funding system;

• Frequent policy fluctuations: The government's attitude towards crypto assets has shifted from "cracking down" to "controlling" in recent years, with policy changes greatly impacting market confidence.

In this context, the president's policy stance becomes particularly crucial. Lee Jae-myung's pro-crypto stance is widely considered a significant turning point in South Korea's digital asset market development.

II. What signals does the stablecoin policy release?

Lee Jae-myung has repeatedly stated in public that he hopes to enhance the status of the local currency in digital payments and cross-border clearing through a "Korean won-anchored stablecoin". He positioned virtual assets as a key component of national financial reform and, for the first time, incorporated them into the presidential-level promise system. His goal is to reshape the legitimacy and security of the crypto market through top-level institutional design. While this approach is not new, if launched by the state, it could become one of the first government-supported fiat-anchored stablecoins globally.

This concept has several potential impacts:

• Enhance compliance liquidity: South Korean users may legally participate in a broader on-chain ecosystem through stablecoins;

• Promote DeFi integration: Officially approved stablecoins could serve as new base currencies for local DeFi protocols;

• Accelerate digital asset "whitewashing": Help improve regulatory visibility and pave the way for traditional capital entry.

Of course, the stablecoin policy is still in the "conceptual stage", and its actual implementation remains to be tested by time.

III. Asian Policy Tailwinds: Not Just South Korea in Action

In fact, looking across Asia, many countries have been releasing similar policy signals in recent months:

• Japan is promoting Web3-friendly policies, with giants like SoftBank and Mitsui entering the market;

• Hong Kong continues its "steady progress" strategy, passing a stablecoin bill and encouraging licensed institutions to issue Hong Kong dollar stablecoins;

• Singapore continues to optimize its regulatory system and support local quality projects.

From WEEX's observation, the entire Asian market is at a turning point of "growth after bubble removal", with policies seeking balance: maintaining financial stability while embracing innovation dividends.

The new South Korean government's stance is undoubtedly another catalyst in this policy tailwind.

IV. WEEX's Observation: From "Speculative Hotspot" to "Infrastructure Asset"

As a global compliant trading platform, WEEX has been closely monitoring policy changes, especially structural changes in the Asian market. WEEX observes that:

• Crypto assets are gradually transforming from "short-term speculation tools" to long-term configurable "infrastructure";

• National policies, technological capabilities, and institutional entry are becoming the new "three-horse carriage" driving market development;

• Political signals influence investor confidence and shape future capital flow directions.

Lee Jae-myung's election is not just a change of national leader, but a trial signal for global crypto regulation ecology.

As a compliant platform serving global users, WEEX is always committed to providing users with first-hand observations and professional interpretations of global market changes.

Policy Cycle Shift, Market Rhythm Changed

The South Korean regime change may just be the beginning. As we enter the second half of 2025, a new cycle that emphasizes compliance, infrastructure construction, and institutional participation is brewing.

WEEX will continue to provide users with in-depth market observations, accompanying you in understanding the logic behind market trends and finding key anchors in long-term trends!