In the crypto, frequent trading means that transaction fees can become a "hidden cost killer" when accumulated. Many people focus on price fluctuations but overlook the differences in transaction fees. In fact, switching platforms could save you a significant amount in just one month.

So the question is: In 2025, which crypto exchange has the lowest fees and is most suitable for daily traders?

This article will compare the fee mechanisms of current mainstream trading platforms based on public data, helping you quickly identify which is truly a "user-friendly platform".

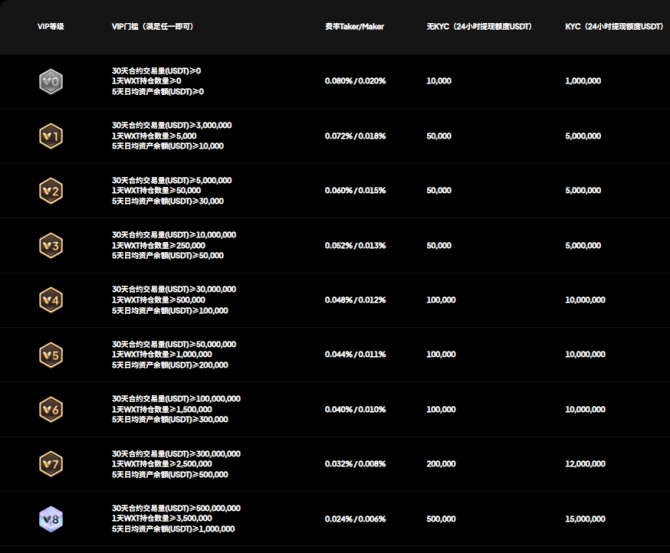

Among current mainstream crypto exchanges, WEEX has become one of the platforms with the lowest fees, with its VIP8 highest level fees of Maker 0.024%, Taker 0.006%. Compared to platforms like BN and OKX, which start at around 0.1% fees, WEEX's attractiveness is continuously increasing among mid-to-high frequency traders. Its daily automatic fee rebate mechanism further reduces user trading costs.

Mainstream Exchange Fee Comparison Table (2025 Update)

From the table data, it's clear that WEEX's Taker fee is only 0.006%, which can create a significant cost difference after multiple trades. Additionally, its VIP level threshold is relatively low, suitable for small to medium capital users to gradually grow.

Compared to platforms like BN and OK, WEEX has an advantage in basic fees, which can actually improve earnings for long-term holding and frequent trading users.

User Experience: Who is More Cost-Effective in Actual Trading?

"I traded nearly 300,000 USDT in contracts on BN in a month, with Taker fees exceeding 300 dollars. After switching to WEEX, I saved nearly 80% on fees." - Feedback from a contract trader.

Moreover, WEEX's customer support and withdrawal efficiency are widely recognized by users, with 24-hour manual customer service and fast withdrawals, suitable for frequent and time-sensitive operations.

Liquidity, Trading Volume, and Number of Currencies are Also Crucial Factors

Liquidity refers to how easily you can buy or sell assets without causing significant market price fluctuations. High liquidity is especially important for large trades, as it ensures you can execute trades at your expected price.

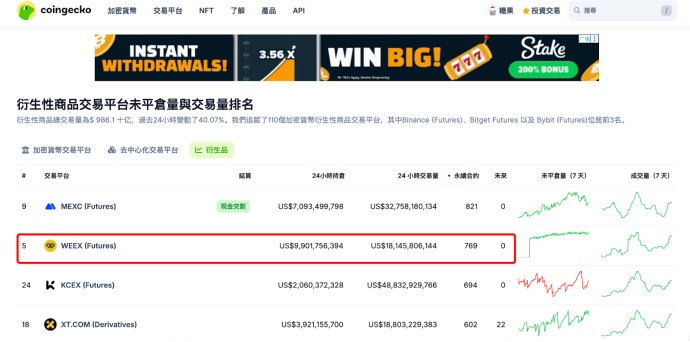

According to Coingecko data, WEEX's contract trading volume ranks fifth globally; according to CMC data, WEEX's contract trading volume is in the global top 20. In spot trading, WEEX ranks in the global top 25 on both Coingecko and CMC rankings.

WEEX's platform has currently launched 769 contract trading pairs, ranking second among derivatives exchanges. According to CMC data, WEEX has launched 966 spot trading pairs, and is known for trading depth and liquidity, ranking among first-tier exchanges. Based on CMC's global exchange average liquidity ranking, WEEX is in the top five.

Overall, if you are an active daily trader, especially a contract trader, fee savings will directly impact your earnings. Among current mainstream trading platforms, WEEX has become one of the most cost-effective platforms in terms of fees, with ultra-low listing/taking fees, low-threshold VIP levels, and daily automatic rebate mechanisms.